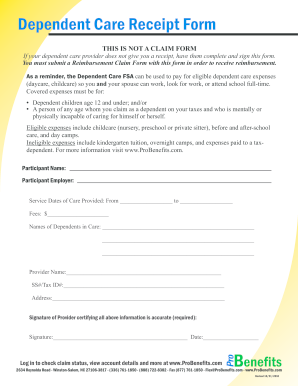

24HourFlex Dependent Care Receipt free printable template

Show details

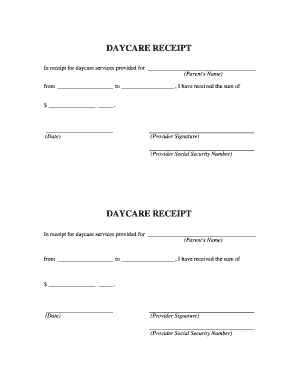

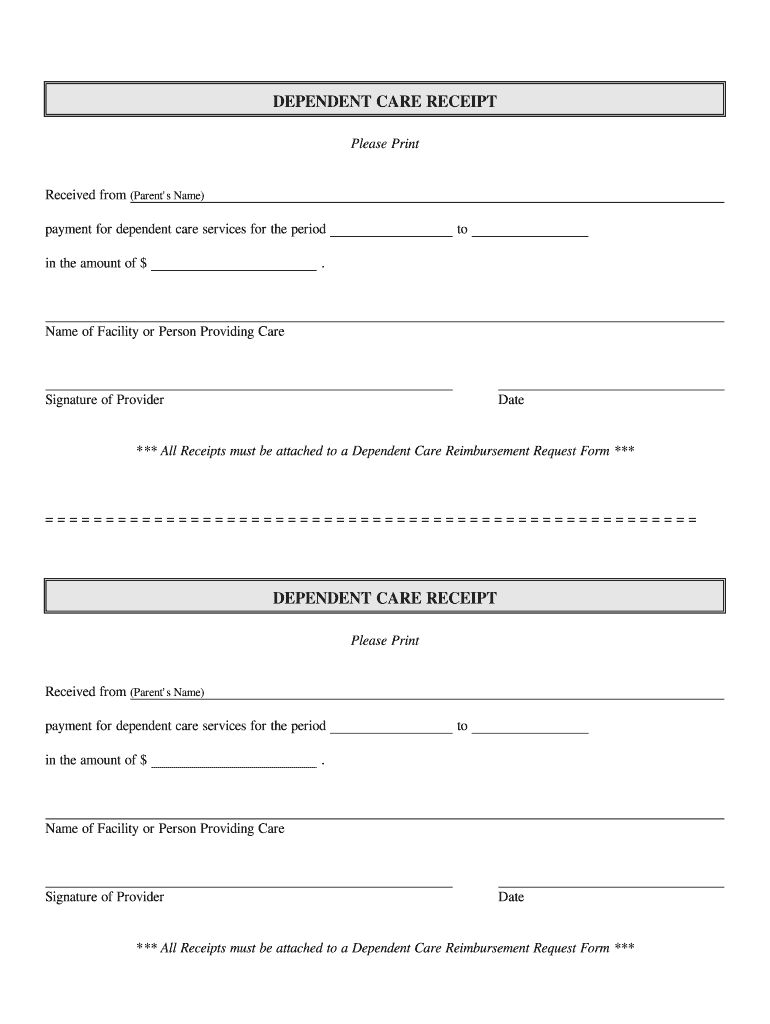

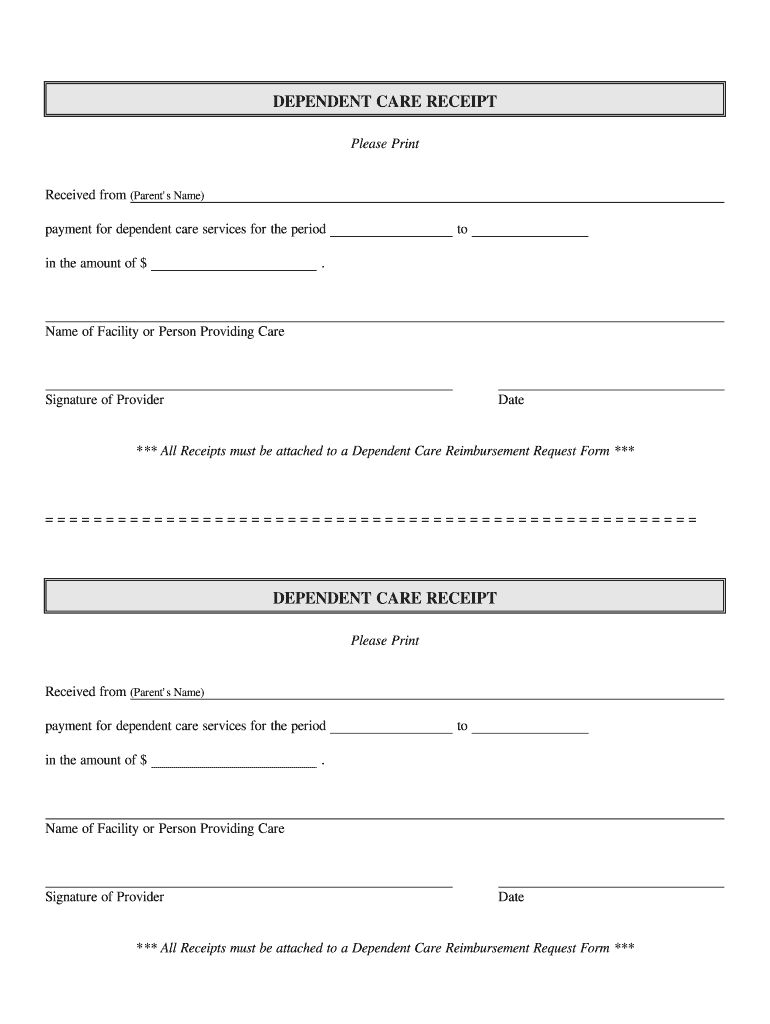

DEPENDENT CARE RECEIPT Please Print Received from Parent s Name payment for dependent care services for the period in the amount of to. Name of Facility or Person Providing Care Signature of Provider Date All Receipts must be attached to a Dependent Care Reimbursement Request Form.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign dependent care receipt template form

Edit your dependent care fsa nanny receipt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dependent care fsa receipt template form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit you may need to include name and relationship to you online

Follow the steps down below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit dependent care receipt form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dependent care fsa receipt form

How to fill out 24HourFlex Dependent Care Receipt

01

Obtain a 24HourFlex Dependent Care Receipt form from your employer or the 24HourFlex website.

02

Fill in your personal information at the top of the form, including your name, address, and employee ID.

03

Indicate the name of the dependent for whom care was provided.

04

Specify the dates for which you are claiming dependent care expenses.

05

Provide the name and address of the care provider.

06

Enter the total amount paid for dependent care services over the specified dates.

07

Attach any required documentation, such as receipts or invoices from the care provider.

08

Sign and date the form to certify the accuracy of the information provided.

09

Submit the completed form and any attached documents to the appropriate department as instructed.

Who needs 24HourFlex Dependent Care Receipt?

01

Parents or legal guardians who incur childcare expenses for dependents while working or looking for work.

02

Employees seeking reimbursement for qualified dependent care expenses through their flex benefits plan.

03

Individuals who qualify for dependent care benefits under an employer-sponsored flexible spending account (FSA).

Fill

babysitter receipt for fsa

: Try Risk Free

People Also Ask about receipt for dependent care fsa

Does a nanny count for FSA?

Employees can use the dependent care FSA to pay for a nanny, au pair, housekeeper, or other similar arrangement where the service provider cares for their children under age 13 to enable both the employee and the spouse to be gainfully employed.

What kind of receipt do I need for FSA?

Pay with your FSA debit card and submit an itemized receipt or Explanation of Benefits (EOB) as substantiation. Note: Please sign the bottom of the claim form authorizing HRCTS to process the claim.

How do you write a cash receipt?

How do you write a receipt for a cash payment? If you are writing out a receipt for a cash payment, include the date, items purchased, quantity of each item, price of each item, total price, type of payment and payment amount, and your business name and contact information.

How do I write a receipt for my nanny?

5 Steps To Make a Nanny Receipt Step 1: Details Of Nanny. First of all, you need to be clear about mentioning the details of the nanny or the caretaker in the receipt. Step 2: About The Service. Then comes the details of the service provided by the nanny. Step 3: Details Of Child. Step 4: Fees. Step 5: Evaluation.

How do you write a receipt example?

No matter how you're making your receipt, every receipt you issue should include: The number, date, and time of the purchase. Invoice number or receipt number. The number of items purchased and price totals. The name and location of the business the items have been bought from. Any tax charged. The method of payment.

How do I submit my nanny expenses to FSA?

You may need to include: date of the expense (or service start and end dates) description of the service. expense amount for reimbursement. name, address, and social security number (or individual tax identification number) of your nanny. dependent's name and relationship to you.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute nanny receipt for fsa online?

pdfFiller has made it easy to fill out and sign fsa receipt template. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an electronic signature for signing my dcfsa receipt template in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your babysitting receipt template and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Can I edit dependent care fsa nanny receipt template on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign babysitter receipt on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is 24HourFlex Dependent Care Receipt?

The 24HourFlex Dependent Care Receipt is a document that is used to report and claim expenses related to dependent care services. It is typically required by flexible spending account (FSA) administrators to substantiate claims for reimbursement.

Who is required to file 24HourFlex Dependent Care Receipt?

Individuals who have incurred dependent care expenses and wish to be reimbursed through their flexible spending account (FSA) are required to file the 24HourFlex Dependent Care Receipt.

How to fill out 24HourFlex Dependent Care Receipt?

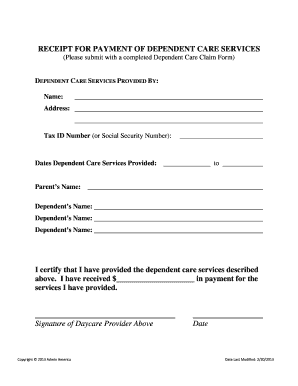

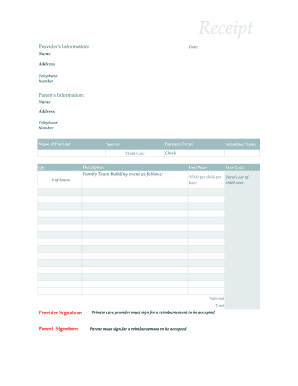

To fill out the 24HourFlex Dependent Care Receipt, you need to provide details such as the provider's name, address, tax identification number, dates of service, and the amount paid for each service. Ensure all fields are accurately completed and sign the receipt.

What is the purpose of 24HourFlex Dependent Care Receipt?

The purpose of the 24HourFlex Dependent Care Receipt is to ensure that employees can document and verify their dependent care expenses for reimbursement purposes under their flexible spending accounts.

What information must be reported on 24HourFlex Dependent Care Receipt?

The information that must be reported on the 24HourFlex Dependent Care Receipt includes the dependent's name, the care provider's information, the services provided, the dates of care, the amounts charged, and the provider’s tax identification number.

Fill out your 24HourFlex Dependent Care Receipt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dependent Care Receipt Template Word is not the form you're looking for?Search for another form here.

Keywords relevant to babysitting receipt

Related to dca receipt template

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.